In business, presentation and security go hand in hand, especially when mailing important financial documents.

Whether you are mailing tax returns, confidential reports, or payroll statements, the type of envelope can help you create the impression you want to project and keep important information safe.

Thankfully, tax envelopes come to the rescue here.

They’re built to guarantee that your documents arrive safely and free of damage. Furthermore, these envelopes, made with quality material and tamper-evident seals, are designed for tax correspondence’s specific needs.

Want to know more about them? Keep reading!

This article lists the major features of tax envelopes and why they are the smart option.

1. Enhanced Security for Sensitive Tax Documents

Protecting confidential tax information is essential, especially when sending important documents through the mail. That is why tax envelopes are designed with security features to safeguard against unauthorized access.

Many options, including custom tax envelopes and double-window styles, come with tamper-resistant designs to ensure privacy. Additionally, they feature security tinting, preventing sensitive details from being visible through the paper.

Other features include self-sealing adhesive seals, making sealed envelopes impossible to open without damage. High-quality paper materials also make the envelopes tear-proof or tamper-resistant.

With rising identity theft and financial crimes, using tamper-proof envelopes provides accountants with peace of mind because they are confident that client information remains confidential.

Furthermore, some envelopes feature holographic seals or watermarks, adding an extra security layer against counterfeiting. Through these security elements, accountants are confident that tax documents reach the intended party without opportunities for unauthorized tampering.

Overall, if you want enhanced security for sensitive tax documents, consider getting accountant tax envelopes from a trusted supplier who can customize them per your needs.

2. Pre-Printed Labels for Easy Identification

Organization is critical when sending taxes by mail, and pre-printed labels ensure convenience when mailing. Most envelopes for accountants contain well-marked sender and receiver sections, making it convenient for sorting and processing documents.

Others include spaces for return addresses to help mail undeliverable items. The convenience of pre-printed envelopes enables you to avoid hand-labeling, thus minimizing the chances of making any mistakes.

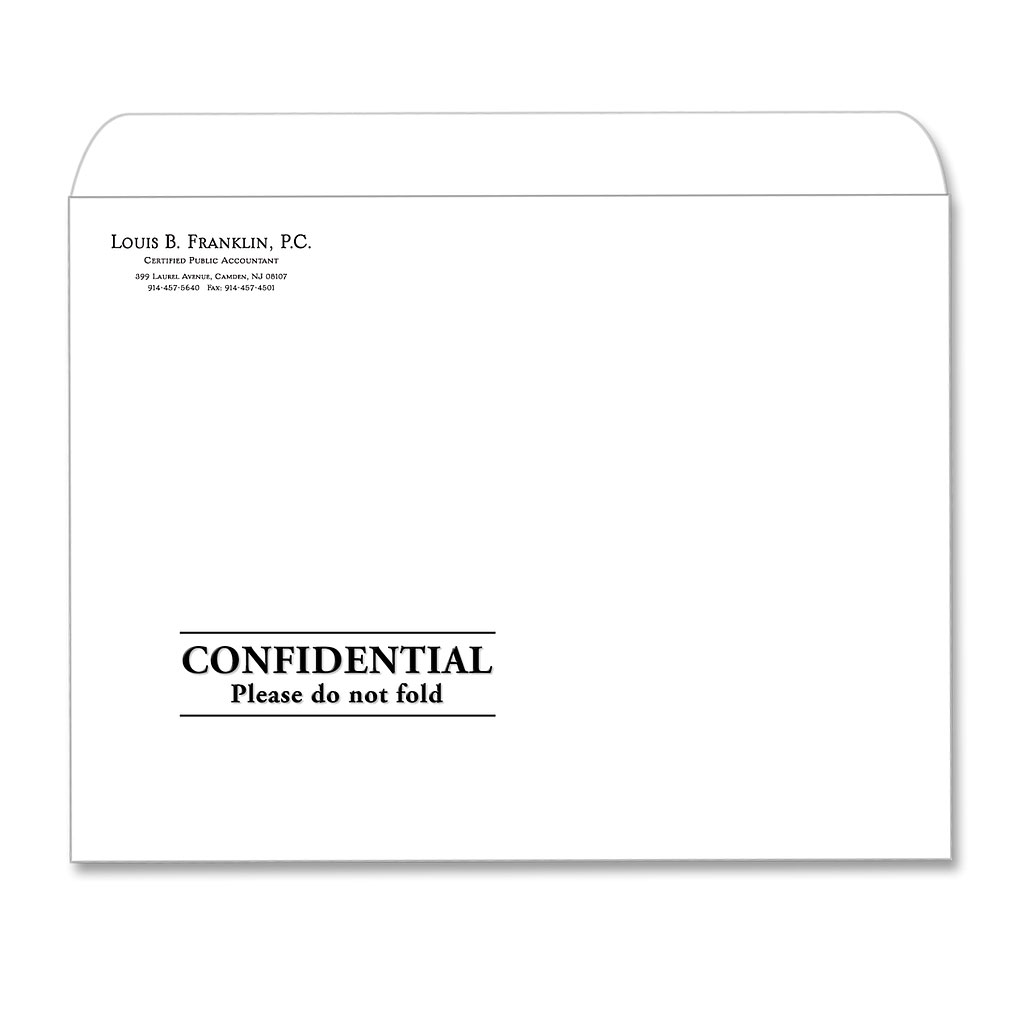

The labels can also include “Confidential” or “Tax Documents Enclosed” warnings for the contents, letting recipients know they should be sensitive.

Furthermore, labels simplify the organization of handling documents, which allows accountants to process and deliver tax files faster. In fast-paced accounting offices, this level of automation is highly valuable.

3. Long-Lasting Building

Tax returns must withstand transit handling; accountant tax envelopes get them in one piece. Heavy-duty paper accountant tax envelopes won’t bend, tear, or break. Reinforced seams on some envelopes strengthen heavier materials, such as multi-page returns and attachments.

In addition, security-tinted envelopes offer an added level of security by concealing contents. Heavy-duty envelopes are cost-effective for accountants handling large amounts of paperwork, avoiding expensive errors, and ensuring document integrity. There are even water-resistant envelopes that protect contents from accidental water exposure.

Thick envelopes also ensure excellent protection against physical abuse, and all the tax documents are sent in their original state when posted. Accountants who invest in durability minimize the loss or damage of papers, generating client satisfaction and trust.

4. Various Sizes and Types of Closure

Different tax forms require different envelope sizes, and accountant tax envelopes are available in various sizes to suit each need. Single-page returns can be mailed in standard letter envelopes; large envelopes can hold entire tax return booklets.

With window cut-out envelopes eliminate readability from printed pages, rendering hand addressing obsolete. Closure types also vary in peel-and-seal, self-seal, and moisture-activated adhesives, each providing ease and security.

Accountants can choose envelopes according to the mailing needs of their business, offering efficiency and professionalism.

Some envelopes even have dual-layer security flaps, which keep contents confidential and avoid accidental opening. Having different sizes to choose from ensures that accountants have a tailor-made solution for each kind of document, which further optimizes workflow efficiency.

Gusseted envelopes, which stretch to accommodate bulkier contents without compromising security, are also available for businesses.

5. Professional Presentation

Apart from security and convenience, accountant tax envelopes assist a company in presenting professionalism. With custom printing, companies can incorporate a logo, telephone number, and association symbols, making their brand known.

Also, a well-designed envelope gives the client a glossy and reputable impression of the firm, demonstrating quality care. Furthermore, high-quality finish envelopes or embossing features represent sophistication. The professional presentation demonstrates customer confidence and trust, making them believe more in the firm’s services.

Companies that brand envelopes also provide customers with a more unified and professional image. Quality envelopes demonstrate care for excellence, making accountants stand out. In a competitive business environment, such considerations as professional branding significantly impact client satisfaction and retention.

Conclusion

Tax accountant envelopes are required to send tax papers professionally and securely. Using tamper resistant security, pre-printed labels, durable construction, and a wide variety of sizes and closure types, they offer convenience and peace of mind.

Additionally, a professionally branded envelope adds a touch of professionalism to a company and, bulk ordering capabilities allow for cost management as well as continuous access to quality mailing products.

Lastly, using quality tax envelopes is an easy and effective method to improve operational efficiency and maintain professional excellence in the industry.